A home equity loan line of credit (HELOC) offers homeowners the flexibility to borrow against their home’s equity as needed, akin to a revolving credit card. But this seemingly simple financial tool can become complex when navigating fluctuating interest rates, potential tax implications, and the risk of foreclosure if payments fall behind.

Toc

What is a Home Equity Loan Line of Credit (HELOC)?

A home equity loan line of credit, often referred to as a HELOC, is a type of second mortgage that enables homeowners to tap into the equity built up in their homes. Unlike a traditional home equity loan, which provides a fixed sum of money, a HELOC operates similarly to a credit card, allowing you to withdraw funds as needed up to a certain limit.

Definition and Classification of HELOC

A home equity loan line of credit is a form of revolving credit that uses your home’s equity as collateral. It falls under the category of secured loans, meaning that in case of default, the lender can seize your property to recoup their losses.

How Does a Home Equity Loan Line Of Credit Work?

To understand how HELOC works, it’s essential first to know what equity means. In simple terms, equity is the difference between your home’s current market value and the amount you owe on your mortgage.

Let’s say your house is currently worth $300,000 and you have an outstanding mortgage balance of $200,000. This means you have $100,000 in equity. With a HELOC, you can generally borrow up to 85% of your home’s equity, so in this scenario, you could have access to a line of credit of up to $85,000.

Key Features of a HELOC

- Draw and Repayment Periods: A HELOC typically consists of two main phases: the draw period and the repayment period. During the draw period, which usually lasts for about ten years, you can borrow from your available credit line, paying only interest on the amounts you withdraw. After this period, you transition to the repayment phase, where you must repay both principal and interest over a set term, often around twenty years.

- Variable Interest Rates: One of the defining characteristics of a home equity loan line of credit is its variable interest rates. This means your monthly payments can fluctuate based on changes in the market, making it essential to plan for potential increases in your payment amounts.

It’s important to note that HELOCs are similar to adjustable-rate mortgages (ARMs) in that both have interest rates that fluctuate based on market conditions. ARMs are typically used for primary mortgages, while HELOCs are considered second mortgages. Understanding how ARMs work can provide valuable insights into the potential risks and benefits of a HELOC. - Difference from Traditional Home Equity Loans: While both HELOCs and traditional home equity loans allow you to access your home’s equity, the primary distinction lies in how the funds are distributed. A home equity loan provides a lump sum with fixed monthly payments, whereas a HELOC allows for flexible borrowing, letting you draw only what you need when you need it. This feature makes HELOCs a popular choice for homeowners looking to fund ongoing or unpredictable expenses, such as home renovations or children’s college tuition.

- Potential Tax Implications: Another benefit of a HELOC is that interest payments may be tax-deductible, making it an attractive financing option. However, due to changes in the 2017 Tax Cuts and Jobs Act (TCJA), the deductibility of these interest payments depends on how the funds are used. For example, if you use the funds to improve your primary residence, the interest may be tax-deductible. Still, if you use them for other purposes like paying off consumer debt or funding a vacation, the interest may not be deductible. It’s crucial to consult with a tax professional to understand how the TCJA may impact your specific situation.

Using a HELOC for Home Improvements

Homeowners frequently turn to a home equity loan line of credit as a financing option for various home improvement projects. Whether you’re planning a minor upgrade or a significant renovation, a HELOC can help facilitate these changes.

Benefits of Utilizing a HELOC for Home Improvements

- Potential Tax Benefits: Interest payments on a HELOC used for home improvements may be tax-deductible, offering an additional financial incentive. For instance, if you take out a $50,000 HELOC for a kitchen remodel and pay $3,000 in interest during the year, you might be able to deduct that $3,000 in interest on your federal income taxes, potentially reducing your tax liability. It’s important to note that the deductibility of interest payments on HELOCs is subject to certain limitations, such as the amount of debt you can deduct and your overall tax liability. Consulting with a tax advisor is crucial to understand the specific rules that apply to your situation.

- Lower Interest Rates: Compared to personal loans or credit cards, HELOCs generally offer lower interest rates, making them an attractive option for financing home renovations.

- Flexibility in Borrowing: One of the standout features of a home equity line of credit loan is the ability to borrow only what you need, when you need it. This flexibility can be especially advantageous if your project costs less than expected or if you encounter unforeseen expenses during renovations.

Examples of Projects Funded by a HELOC

A HELOC can be utilized for a variety of home improvement endeavors, including but not limited to:

- Kitchen and bathroom remodels

- Outdoor enhancements like decks or patios

- Finishing a basement or attic space

- Upgrading to energy-efficient windows, appliances, or insulation

Imagine transforming your cramped, outdated kitchen into a spacious, modern culinary haven. Or perhaps you envision creating a luxurious master bathroom with a soaking tub and walk-in shower. A HELOC can help you bring these dreams to life by providing the necessary funds for your home improvement projects.

Planning Your Home Improvement Project

When embarking on a home improvement project, it’s vital to create a comprehensive budget that encompasses all costs associated with materials and labor. Conduct thorough research on contractors, obtain multiple quotes, and consider the potential return on investment, particularly for projects that enhance energy efficiency or curb appeal.

Qualifying for a HELOC

To secure a home equity loan line of credit, lenders evaluate several key factors during the application process.

1. https://thegioiloaica.com/archive/9457/

2. https://thegioiloaica.com/archive/9456/

Credit Score and Debt-to-Income Ratio

Most lenders require a minimum credit score of 620 for HELOC approval. Additionally, they will assess your debt-to-income (DTI) ratio, which measures your monthly debt obligations against your monthly income. A lower DTI ratio is preferred, indicating your capability to manage financial commitments effectively.

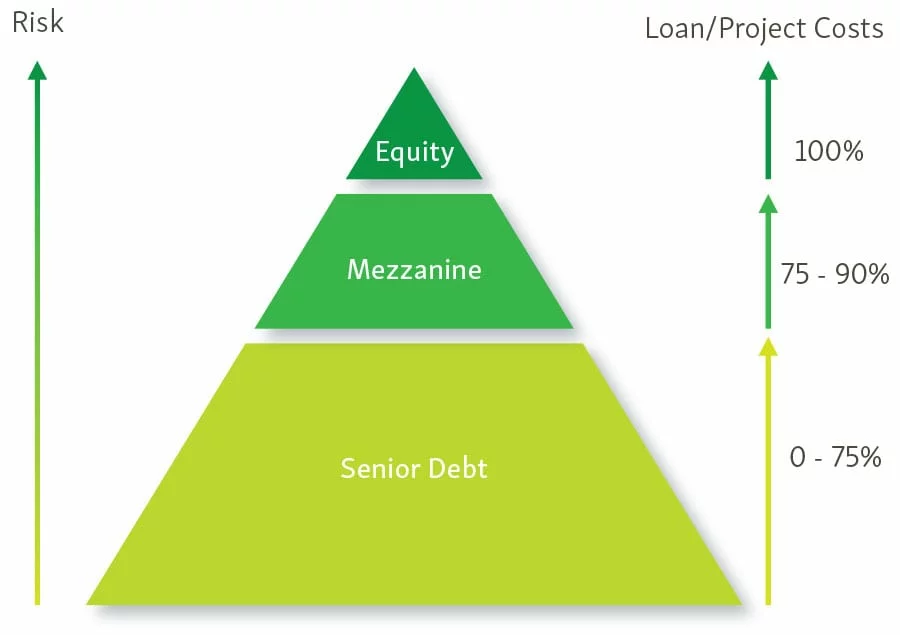

Home Equity and Loan-to-Value Ratio

To qualify for a HELOC, having substantial equity in your home is essential. The loan-to-value (LTV) ratio compares your outstanding mortgage balance to your home’s current value. Lenders typically allow you to borrow up to 85% of your home’s value, minus any existing mortgage debt.

Required Documentation for Application

When applying for a home equity loan and line of credit, you will need to provide various documents, including:

- Proof of income (e.g., pay stubs, tax returns)

- Recent bank statements

- Current mortgage statements

- Home appraisal documents

- Homeowner’s insurance policy

While a HELOC can be a valuable resource for financing home improvements, potential risks and drawbacks should be carefully considered.

Variable Interest Rates

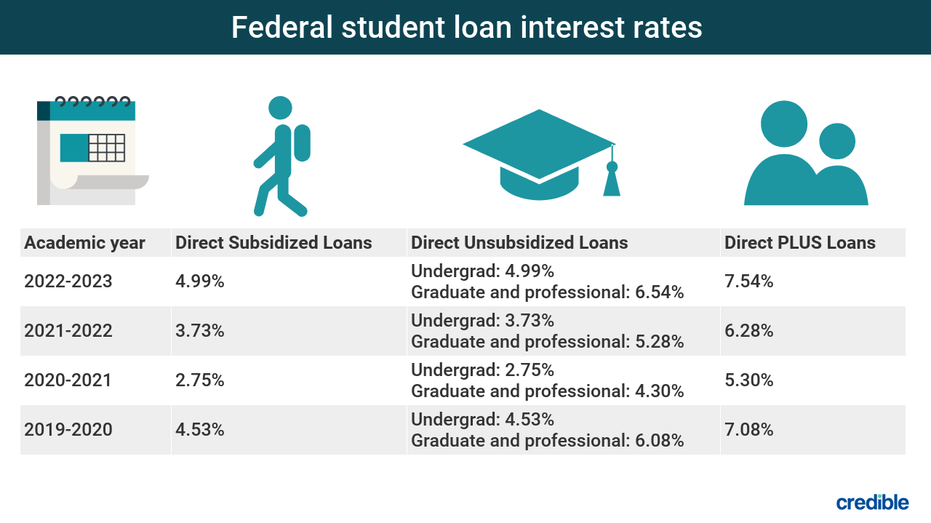

One of the most significant risks associated with a HELOC is its variable interest rate. As market interest rates fluctuate, your HELOC rate may adjust, impacting your monthly payments. It’s crucial to consider how rising rates could affect your budget over time. In recent months, the Federal Reserve has raised interest rates several times to combat inflation. This trend has resulted in higher interest rates for HELOCs, making it more expensive to borrow against your home’s equity. It’s crucial to factor in the potential impact of these rising rates when considering a HELOC.

Risk of Foreclosure

Since your home serves as collateral for a HELOC, failing to make timely payments could lead to foreclosure. This risk underscores the necessity of responsible borrowing and ensuring that you can comfortably manage your monthly payments.

Alternative Financing Options

While HELOCs can offer lower interest rates compared to personal loans, personal loans often have fixed interest rates, providing more predictable monthly payments. Cash-out refinancing can provide a lump sum of money, but it also involves refinancing your existing mortgage, potentially increasing your monthly payments and extending the loan term. If a HELOC does not align with your financial situation or needs, consider these alternative financing options for home improvements.

Tips for Securing the Best HELOC Rate

Despite the potential risks, a HELOC can be a valuable tool if you understand its intricacies and take steps to secure the best possible terms. Here are some tips to help you navigate the HELOC market and obtain the most favorable rates and conditions.

Shop Around for Competitive Rates

By taking the time to compare offers from various lenders, you can uncover the most competitive interest rates and loan terms that best suit your financial needs. Different lenders often have unique criteria and promotional offers, so exploring multiple options can empower you to make an informed decision. This thorough comparison can lead to significant savings over the life of your loan, making it a crucial step in the borrowing process.

Explore Fixed-Rate Options

While variable-rate Home Equity Lines of Credit (HELOCs) may initially entice borrowers with lower introductory rates, opting for a fixed-rate HELOC can provide greater stability and predictability in your monthly payments. This fixed-rate option serves as a safeguard against the potential for rising interest rates in the future, allowing you to budget more effectively and avoid unexpected financial strain as market conditions change.

Negotiate Lower Closing Costs

When applying for a HELOC, it’s wise to inquire about the closing costs involved in the process. These costs can vary significantly among lenders and can include various fees such as appraisal, origination, and processing fees. By actively exploring options to minimize these expenses, you may discover that some lenders are open to negotiating and may even be willing to waive or reduce certain fees altogether. This proactive approach can lead to substantial savings, making your overall borrowing experience more economical.

Frequently Asked Questions (FAQ)

1. https://thegioiloaica.com/archive/9455/

2. https://thegioiloaica.com/archive/9456/

Q: What is the typical amount I can borrow with a HELOC?

A: The amount you can borrow with a home equity line of credit typically depends on your home’s equity and the lender’s guidelines. Most lenders allow access to up to 85% of your home’s value, minus any existing mortgage debt.

Q: How long does it take to get approved for a HELOC?

A: The approval timeline can vary by lender, but it generally takes a few weeks.

Q: Can I use a HELOC for any home improvement project?

A: While HELOCs are frequently used for home improvements, some lenders may impose restrictions on the types of projects financed. It’s essential to discuss your specific project with the lender.

Q: What happens if I can’t make my HELOC payments?

A: Failing to make payments on your HELOC can result in foreclosure. It’s crucial to contact your lender immediately to discuss possible solutions.

Q: What are the common fees associated with HELOCs?

A: Common fees may include origination fees, appraisal fees, and closing costs, which can vary by lender.

Conclusion

The home equity loan market has experienced significant growth in recent years, driven by factors such as rising home values and increasing demand for home improvements. This trend suggests that HELOCs and traditional home equity loans are becoming increasingly popular financing options for homeowners.

A home equity loan line of credit can serve as a powerful financial tool for homeowners looking to finance their home improvement projects. By leveraging the equity in your home, a HELOC provides flexible borrowing options, potentially lower interest rates, and the possibility of tax-deductible interest. However, it’s vital to weigh the associated risks and explore strategies to secure the best possible terms. With careful planning and responsible borrowing, a HELOC can unlock your home’s full potential and help you create your dream living space. Consider consulting with a financial advisor to determine if a home equity loan line of credit is the right choice for your specific financial situation.